Last week we published our latest app update to the Apple App Store and Google Play Store. This update includes many new features, improvements, and bug fixes, including:

- Added new US banks and credit unions

- Improved bank deposit speed

- Revamped US bank deposit status updates

- Updated Bitcoin price feed

Added new US banks and credit unions

When we first launched US bank support, we supported 17 of the top banks in the country. Our latest update adds support for 46 new US banks and credit unions, bringing the total number of supported US banks and credit unions to 63. You can find a complete list of these banks in our FAQ and on the “Add bank” screen of the Abra wallet.

Improved bank deposit speed

One of our goals is to make adding money to the Abra wallet easier and faster. To this end, we will be running tests to shorten the amount of time it takes to add money via bank deposit from 2-3 business days to 1-2 business days. In some cases we may require additional verification to protect the security of our customers’ accounts, which could add more time. However, in the best case scenario an Abra customer can now initiate a deposit in the morning before 12:00pm PT and see the money land in their wallet by the end of the business day. Try it out and let us know how it works for you!

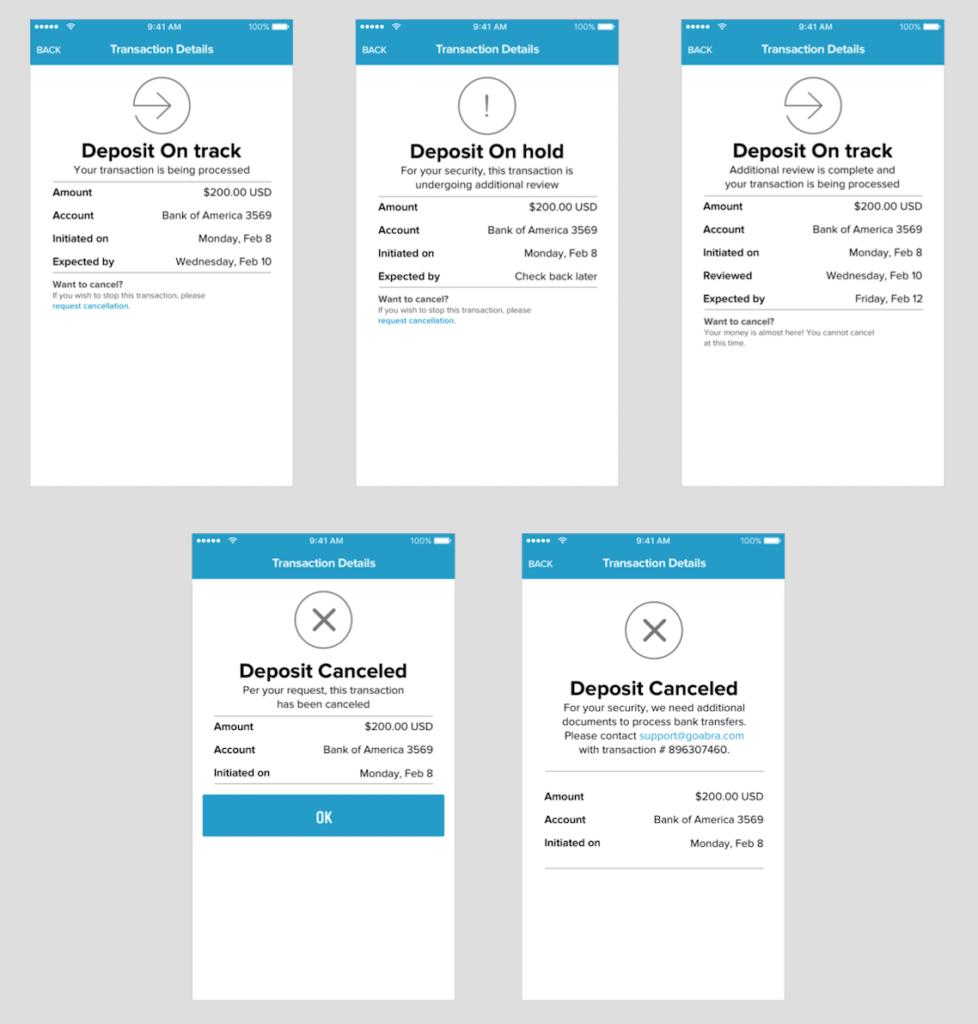

Revamped bank deposit status updates

The Abra wallet will now provide more granular updates to let users know what’s happening during each step of the bank deposit process between the time a deposit is initiated and the time it succeeds or fails. Now users can rest easy knowing that their request has been received and is being processed according to standard procedures.

You can see an example of these new updates in the screenshots below:

Update bitcoin price feed from Coinbase to XBX

We were previously using Coinbase to get the price we used for bitcoin conversions. As of this most recent app update, our rates are now based off of TradeBlock’s XBX Index. This will result in a conversion rate that more closely tracks the global average across institutional bitcoin exchanges.

Keep the feedback coming!

All of these improvements are the result of feedback sent to us by our users. A big thank you to everyone who has contributed feedback so far!

Got a question or comment about these updates? Let us know in the comment section below or send us a message using the “Contact us” button in the main menu of the Abra app.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

Jane

2037 days agoHi.what should i do to transfer my earnings to my bank that is not ever listed from ABRA.my bank is american savings bank.

Daniel McGlynn

2033 days agoJane,

You should contact [email protected] on our team will help figure out the best fit for your situation. Thanks,